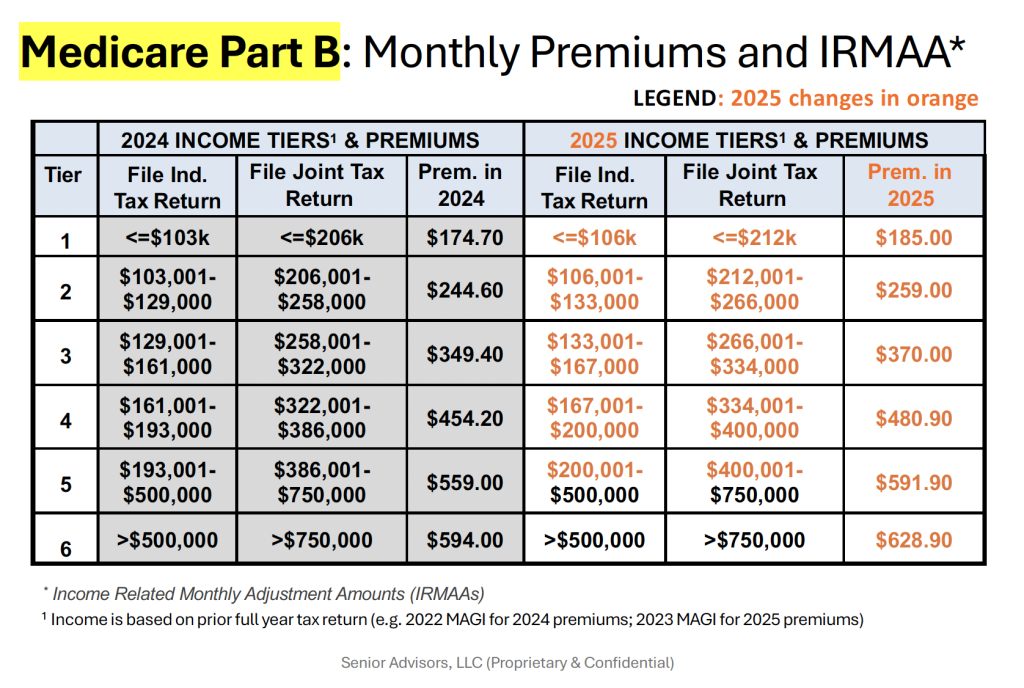

CMS just announced the updated Part B premiums for 2025.

- The standard Part B Premium increased $10.30/month from $174.70/month in 2024 to $185/month in 2025.

- Part B deductible Increased $17 from $240 in 2024 to $257 in 2025.

Last month, Social Security announced the 2025 Cost of Living Adjustment will be 2.5%

- On average, Social Security retirement benefits will increase by about $50 per month starting in January.

2025 IRMAAs (Income Related Monthly Adjustments)

The Income Related Monthly Adjustment Amounts (IRMAAs) were also updated for 2025. You can find the tables below for individuals with income greater than $106,000 (or joint filers with income greater than $212,000). This income is based on your MAGI (Modified Adjusted Gross Income) from your 2023 Tax Return. These IRMAAs only affect about 8% of people with Medicare Part B.

Click here to read how to ensure you’re NOT overpaying for your Medicare coverage.

(will open in new tab)

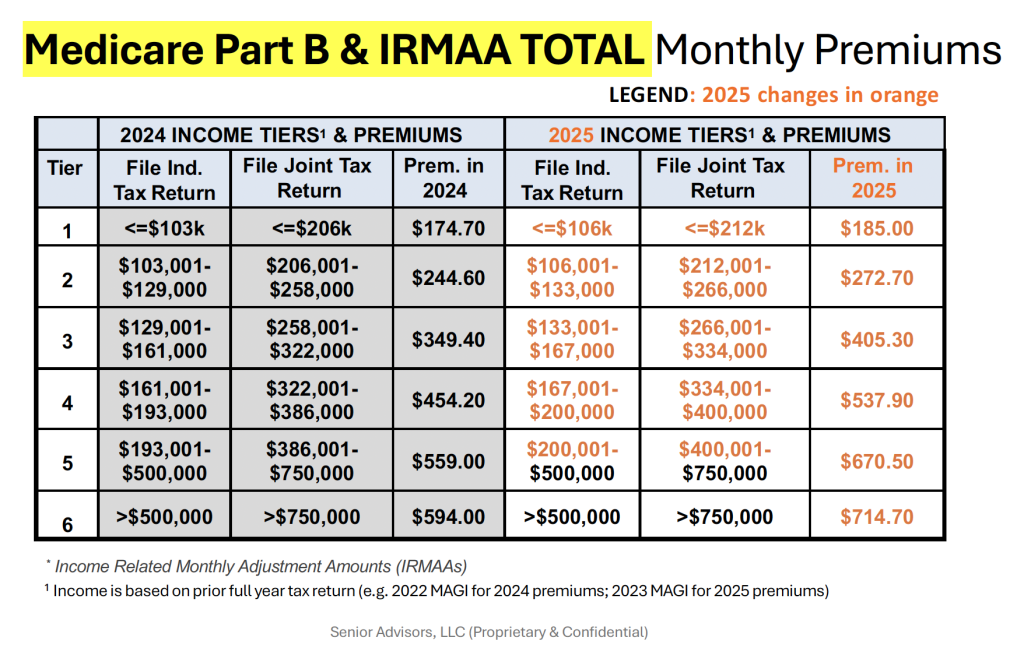

If you are in one of the higher income brackets for the Part B IRMAAs, there is an additional IRMAA for the Part D Drug Coverage. The updated table for 2025 can be found below.

The table below shows the sum of the Part B Premium, Part B IRMAA, and Part D IRMAA for the higher income brackets for 2025.

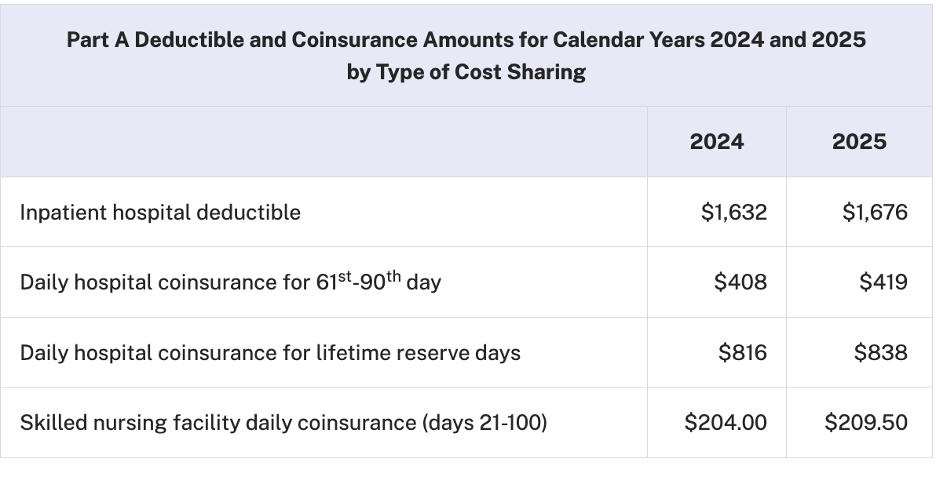

The other changes for 2025 that were included in the announcement are below.

If you have a Medicare Supplement Plan F, Plan G, or Plan N, the Part A cost-sharing is fully covered by the Supplement so these changes below will not impact you.