Over the last several years, the two most popular Medicare Supplements have been Plan G and Plan N.

We wanted to create a short video and article to explain some of the differences between these two plans.

Before we discuss the differences, we want to highlight some of the key characteristics of ALL Medicare Supplement Plans.

Some Great Characteristics of All Medicare Supplement Plans

- Coverage is Federally Regulated – this means that all carriers that offer the Medicare Supplement Plan G (or Plan N) must provide the EXACT same Federally regulated coverage

- No Private Network – Regardless of the carrier providing your Medicare Supplement, there is NO private network with Medicare Supplements. You can see ANY doctor/hospital in the country that accepts Medicare.

- No Referrals Required – you do not need a referral to see a specialist.

- No Prior Authorizations or Pre-Approvals (other than custom wheelchairs)

- Guaranteed Renewable for Life – you are able to keep your Medicare Supplement policy the rest of your life (as long as you continue to pay the premium). You can never be cancelled out of a Medicare Supplement

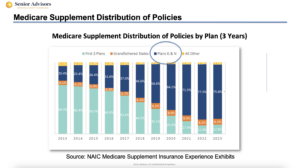

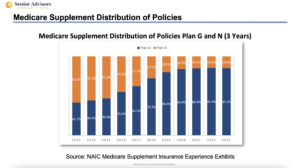

Medicare Supplement Distribution of Policies

As you will see in the charts below, Medicare Supplement Plan G and Plan N make up the majority (75+%) of new Medicare Supplement policies.

Between the two plan types, Plan G makes up about 85% compared to about 15% Plan N.

Plan G and Plan N Coverage Differences

Plan G and Plan N are both great plans. Plan N is a little less expensive than Plan G; in most states, the Plan N premium would be about $30-$40/month lower than the Plan G premium. (In NY, it is a much larger difference – about $70/month).

Both Plan G and Plan N provide the same coverage under Part A of Medicare (Hospital); basically providing 100% coverage for Part A services.

There are three differences in coverage between Plan G and Plan N and they are all under Part B (Medical Coverage) of Medicare.

- With Plan G, you are only responsible for the Part B deductible ($240 in 2024). After you meet the Part B deductible, Medicare pays 80% and the Plan G pays the other 20%. There are no copays, no coinsurance, etc. With Plan N, after you pay the Part B deductible ($240 in 2024), there are copays up to $20 for doctor and specialists visits.

- With Plan N, there is also copay of $50 for the Emergency Room. There is no copay with Plan G.

- Plan N does NOT cover Part B Excess Charges (up to 15% more than the Medicare Approved amounts). If doctors choose to charge the Excess Charges, you would be responsible with a Plan N, whereas Plan G would cover the Part B Excess Charges. Part B Excess charges are not very common today, but this could change in the future if Medicare continues to make cuts to Provider reimbursements to sustain the Medicare program.

Click below to see the Detailed outline of coverage for Plan G and Plan N.

Medicare Supplement Open Enrollment vs Guaranteed Issue

We need to provide a brief explanation of two Medicare Supplement enrollment periods called Medicare Supplement Open Enrollment and Medicare Supplement Guaranteed Issue.

- Medicare Supplement Open Enrollment Period – when someone first enrolls in Medicare Part B (this could be at age 65 or later if they worked past age 65), there is a 6-month timer called the Medicare Supplement Open Enrollment Period which begins on the Part B Effective Date. During this 6-month period, the individual can get any Medicare Supplement they are eligible for with no medical underwriting; basically, they are guaranteed to get whichever Supplement they want. After this 6-month period, to get into a Medicare Supplement (or switch Medicare Supplements) there is medical underwriting required (in most cases). For individuals that want a Medicare Supplement, this is generally the time we recommend getting one because we can’t guarantee you will be able to get one in the future.

- Medicare Supplement Guaranteed Issue Period – For individuals that are past their 6-month Medicare Supplement Open Enrollment Period (Part B date is greater than 6 months in the past), there are some exception scenarios that allow these individuals to get a Medicare Supplement without medical underwriting. These are generally situations that were outside the control of the individual; so the government provides some protections to allow these individuals to get a Medicare Supplement with no Underwriting. Some of the common scenarios for Guaranteed Issue are: Loss of Retiree Health Coverage, Move outside a Service Area for a Medicare Advantage Plan, or the Medicare Advantage Plan is no longer being offered. In these situations, someone who has health conditions could still get a Medicare Supplement due to the Guaranteed Issue regulations.

How does this affect the Plan G versus Plan N discussion?

Well, Plan G is the Guaranteed Issue Plan since 2020. So, for individuals that have a Guaranteed Issue situation (and they have some health conditions), if they enroll in a Medicare Supplement, it will likely be a Plan G Supplement. Some of the speculation is that this could result in higher rate increases for Plan G versus Plan N in the future.

Three Key Takeaways

- Coverage and Cost Differences – Plan G and Plan N both provide great coverage. Plan G is more robust and provides a Fixed out of pocket exposure (just $240 in 2024). Plan N saves a little premium but has more variable costs (copays and potential Part B excess charges).

- Plan G is the Guaranteed Issue Plan which some speculate could result in higher rate increases in the future.

- Part B Excess Charges are very uncommon today. However, Medicare continues to reduce Provider reimbursements so this could change in the future, which could result in more exposure for Plan N policyholders.

While we won’t declare a clear winner (depends on many factors), we hope you found this information helpful.